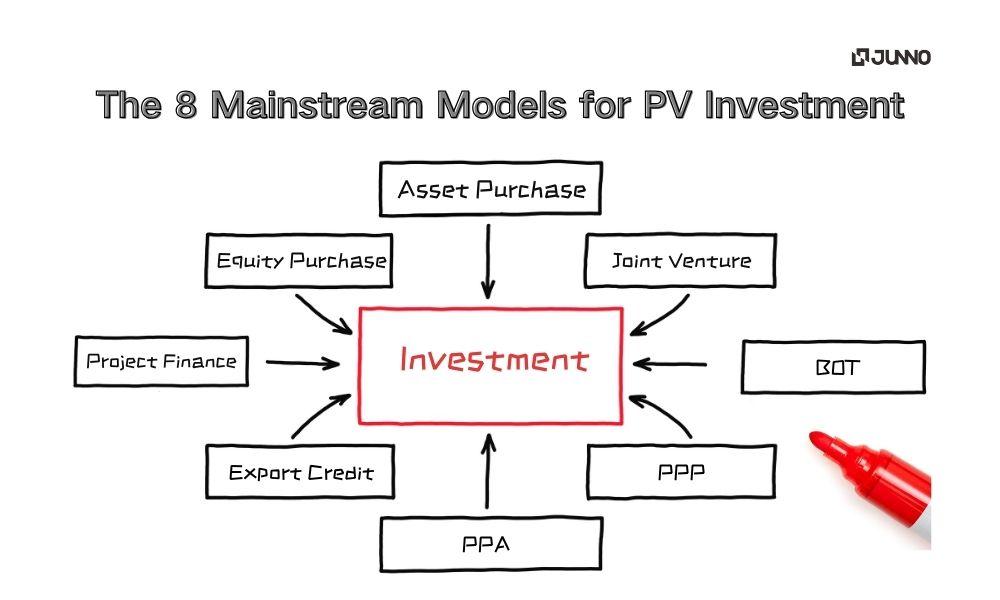

Common Investment Models for PV Projects

1. Asset Purchase

A direct acquisition refers to the buyer purchasing the target project's assets directly, rather than acquiring equity in the company.

Advantages: The buyer may selectively acquire specific assets, thereby circumventing potential liabilities or legal disputes associated with the target company.

2. Equity Purchase

Equity acquisition refers to the buyer gaining control of a project by purchasing part or all of the target company's equity.

Advantages: It allows for the inheritance of the target company's existing contracts and business relationships, thereby simplifying management and operations.

3. Joint Venture

The cooperative development model refers to the establishment of a joint venture between the buyer and seller, or other investors, to jointly develop and operate new energy projects.

Advantages: Risks and costs can be shared while leveraging the resources and expertise of all parties.

4. Project Finance

Project finance involves raising capital for the development and construction of new energy projects through specialised financing structures, typically relying on the project's own cash flow and assets as repayment security.

Advantages: Frequently employed for large-scale projects, it effectively disperses and manages risks.

5. Build-Operate-Transfer (BOT)

The BOT model refers to a scheme where the buyer undertakes the construction and operation of a project, subsequently transferring it to the original owner or government upon completion of the agreed operational period.

Advantages: Suitable for projects requiring long-term investment and operational management.

6. Public-Private Partnership (PPP)

The PPP model refers to public-private partnerships where the public and private sectors jointly invest in and manage new energy projects. The private sector typically undertakes project construction and operation, while the public sector provides policy support and partial funding.

Advantages: Helps mitigate investment risks for the private sector.

7. Export Credit

Through export credit, buyers may obtain low-interest loans from their home government or financial institutions to purchase new energy equipment and technology from abroad.

Advantages: This reduces project financing costs and promotes international cooperation.

8. Power Purchase Agreement (PPA)

The PPA model refers to the buyer entering into a long-term power purchase agreement with the electricity purchaser to secure the project's future revenue.

Advantages: It stabilises the project's cash flow and attracts participation from investors and financial institutions.